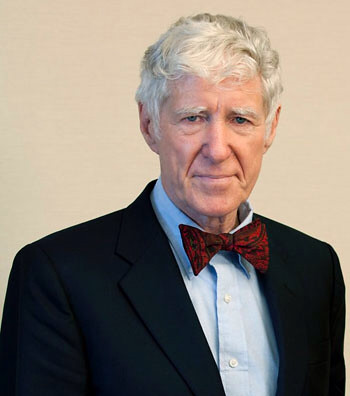

Anyone who has read any of the 50-plus books that Lester Brown has authored or co-authored (in any of the 40-odd languages into which they've been translated) might easily imagine him to be another gloomy environmentalist. At least that was the kind of person I half-expected to encounter when we met at his invitation for breakfast with Junko Edahiro earlier this month in Tokyo.

Brown — whose latest book, 2011's "World on the Edge: How to Prevent Environmental and Economic Collapse," has just come out in Japanese — is president of the Washington- based Earth Policy Institute and one of the world's top environmental policy experts.

Contrary to my expectation, Brown turned out to be humorous and entertaining — as well as a visionary intimately conversant with the facts and figures to support his concerns and policy suggestions. He was especially sanguine about developments in the United States, in particular the recent campaign to close its coal-fired power plants.

"This may be the most important thing happening in the world of climate, because the U.S. is the world's largest economy, and if the largest economy stops using coal that's a huge step forward," said Brown.

In particular he was heartened that Michael Bloomberg, billionaire mayor of New York City, has made a $50-million contribution to the Sierra Club's "Beyond Coal" campaign. The Sierra organization is one of America's oldest and most influential environmental NGOs.

"When Bloomberg lays $50 million on the table and says 'Coal has got to go,' he reaches people that environmentalists can't. He's one of the most successful businessmen of his generation, so this kind of action is exciting," Brown observed.

But Brown is excited about more than just the death of coal.

"More fundamentally, carbon emissions in the U.S. are declining. They have dropped 7 percent in the last four years. That started out as a result of the economic downturn, but it's continuing. The two principal sources of carbon emissions are coal plants and burning gasoline, and we're making enormous progress on both fronts," he noted. More