Energy is essential to the way we live. Whether it is in the form of oil, gasoline or electricity, the worlds' prosperity and welfare depends on having access to reliable and secure supplies of energy at affordable prices. Improving how we acquire, produce, and consume energy is central to becoming economically and environmentally responsible and sustainable.

Thursday, January 26, 2012

Researchers Argue Peak Oil Is Here, Bringing Permanent Volatility

Monday, January 23, 2012

Iran 'Definitely' Closing Strait of Hormuz Over EU Oil Embargo

Mohammad Kossari, deputy head of parliament's foreign affairs and national security committee, issued the warning in respone to a decision by the European Union on Monday to impose an oil embargo on Iran over the country’s alleged nuclear weapons program.

“The pressure of sanctions is designed to try and make sure that Iran takes seriously our request to come to the table,” EU foreign policy chief Catherine Ashton said.

However, with Washington’s decision to deploy a second carrier strike group in the Gulf, the EU’s attempt to pressure Iran economically could greatly increase the likelihood of all-out war in the region.

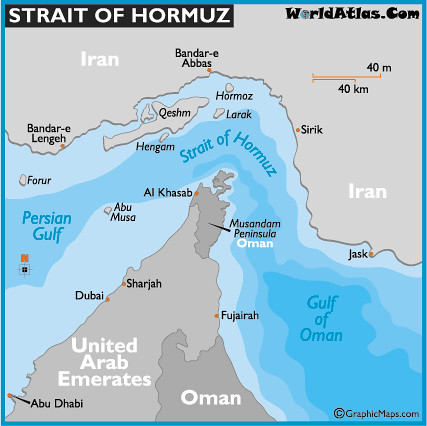

The Strait of Hormuz is the vital link between the Persian Gulf and the Gulf of Oman.

It is also one of the most strategic chokepoints in the world when it comes to oil transit.

With world oil output estimated at some 88 million barrels per day in 2011, the US Energy Information Administration estimated that some 17 million of those barrels passed through the Strait.

If economic sanctions sufficiently pressure Iran to retaliate by closing down the Strait, nearly 20 per cent of worldwide oil trade would be impacted, resulting in a massive spike in global energy costs.

With over half a million regular forces and an additional 120,000 personnel in the country’s elite Revolutionary Guard, analysts believe the consequences of a US-led war against Iran would dwarf recent Western-backed military incursions the Middle East.

Thus far, the US decision to maintain two carrier strike groups in the region has been described as “a routine activity” by Iran.

But the vast US military buildup in the region, which was bolstered when the Pentagon dispatched an additional 15,000 troops to the neighboring nation of Kuwait, was only the latest step in an obvious attempt by Washington to strengthen its military capabilities in the region. More

Saturday, January 21, 2012

Australian Peak Oil Report Released

Thursday, January 19, 2012

Project to pour water into volcano to create power

The Boston Globe has an article on an enhanced geothermal power project in Oregon - Project to pour water into volcano to make power.

Geothermal energy developers plan to pump 24 million gallons of water into the side of a dormant volcano in Central Oregon this summer to demonstrate new technology they hope will give a boost to a green energy sector that has yet to live up to its promise.They hope the water comes back to the surface fast enough and hot enough to create cheap, clean electricity that isn’t dependent on sunny skies or stiff breezes — without shaking the earth and rattling the nerves of nearby residents.Renewable energy has been held back by cheap natural gas, weak demand for power and waning political concern over global warming.

Efforts to use the earth’s heat to generate power, known as geothermal energy, have been further hampered by technical problems and worries that tapping it can cause earthquakes.Even so, the federal government, Google and other investors are interested enough to bet $43 million on the Oregon project. They are helping AltaRock Energy, Inc. of Seattle and Davenport Newberry Holdings LLC of Stamford, Conn., demonstrate whether the next level in geothermal power development can work on the flanks of Newberrry Volcano, located about 20 miles south of Bend, Ore.“We know the heat is there,’’ said Susan Petty, president of AltaRock. “The big issue is can we circulate enough water through the system to make it economic.’’ More

Security by Design

It is commonly assumed that our national security depends only on our capacity to project military power beyond our borders and has little to do with how we organize the internal business of the country.

The nation’s armed strength and its “soft power” are necessary components of security, but they are not—and cannot be—the whole of it. A larger vision of security includes the internal resilience, health, and sustainability of the nation, that is to say its capacity for self-renewal. Real security, in other words, is inseparable from issues of energy policy; education; public health; preservation of soils, forests, and waters; and broadly based, sustainable prosperity.

From this perspective, America is less secure than at any time in its history, despite expenditures in excess of $1 trillion per year for the defense budget and war appropriations. The challenges of the twenty-first century are larger, more complex, and longer-lived than any we have faced before. Of these, the most salient is not terrorism or the ongoing global economic crisis, but rather the threat posed by rapid climate destabilization.1

What was a solvable problem when first presented to President Lyndon Johnson in 1965 is approaching irreversible catastrophe. The heart of the problem is our failure to establish a coherent and farsighted energy policy despite the verbal commitments of every president since 1973 to raising energy efficiency and developing renewable energy sources. That failure, in turn, has amplified many other problems now grown into crises, including the unnecessary expenditure of trillions of dollars paid to unfriendly governments to secure oil resources that we waste because of inefficiency; foreign policy entanglements in politically unstable regions; the resulting military burdens—financial and human—of fighting wars to maintain access to energy that we otherwise would not need; and blowback from consequences that we fail to anticipate. More

Sunday, January 15, 2012

Independent Panel to Start Inquiry Into Japan’s Nuclear Crisis

A powerful and independent panel of specialists appointed by Japan’s Parliament is challenging the government’s account of the accident at a Fukushima Daiichi nuclear power plant, and will start its own investigation into the disaster — including an inquiry into how much the March earthquake may have damaged the plant’s reactors even before the tsunami.

Kiyoshi Kurokawa is the chairman of a new committee that will investigate the accident at a Fukushima Daiichi nuclear power plant. The bipartisan panel with powers of subpoena is part of Japan’s efforts to investigate the nuclear calamity, which has displaced more than 100,000 people, rendered wide swaths of land unusable for decades and spurred public criticism that the government has been more interested in protecting vested industry interests than in discovering how three reactors were allowed to melt down and release huge amounts of radiation.

Several investigations — including inquiries by the plant operator, Tokyo Electric Power, and the government — have blamed the scale of the tsunami that struck Japan’s northeastern coast in March, knocking out vital cooling systems at the plant.

But critics in Japan and overseas have called for a fuller accounting of whether Tokyo Electric Power, or Tepco, sufficiently considered historically documented tsunami risks, and whether it could have done more to minimize the damage once waves hit the plant.

Questions also linger as to the extent of damage to the plant caused by the earthquake even before the tsunami hit. Any evidence of serious quake damage at the plant would cast new doubt on the safety of other reactors in quake-prone Japan. Tsunamis are far less frequent. More

Wednesday, January 11, 2012

The Peak Oil Crisis: Gasoline in 2012

In recent days there has been much discussion in the press about what might happen to gasoline prices in the coming year.

Cognizant of the fact that retail gasoline is currently running nearly 30 cents per gallon higher than it was in January 2008 the year when prices topped out at a national average of $4.11 and that gasoline futures have risen by 30 cents a gallon in the last few weeks, there is reason for concern. Typical of the stories is one from the Los Angeles Times that quotes Tom Kloza, long-time chief analyst for the Oil Price Information Service and the go-to guy when one needs numbers and forecasts on gasoline prices.

Kloza notes that for the last decade gasoline futures prices, which ultimately determine pump prices, have risen from an autumn low to a spring high by an average of 83 percent. During these years, the annual winter-spring price surge has varied anywhere from 52 to 169 percent making higher prices by summer a fairly sure bet. This year the 2011 low for gasoline on the NY futures market likely will turn out to have been $2.44 a gallon on November 25. If one does the arithmetic using the average price jump of 83 percent, futures prices could be expected to top out in the vicinity of $4.46 a gallon next spring. Adding in the additional 60 cents to get the gasoline taxed and to the nozzle of your pump, we could theoretically be paying a national average on the order of $5.00 a gallon before the 4th of July. This of course assumes that nothing bad happens in the Middle East that restricts or seriously threatens the flow of oil exports and sends prices much higher.

The $5 scenario is too much for Kloza so he settles for a fall-to-spring increase of only 40-45 percent this year which has pump prices topping out between $3.90 and $4.25 a gallon. An increase of only 40-45 percent, of course, would be the smallest winter-spring price rally in this century, but $4 a gallon is something the average American has seen before and can comprehend - forecasting $5 gasoline for six months from now is simply not acceptable considering the economic and political havoc it would be likely to cause. More

Powering Sustainable Energy for All

As a child growing up during the Korean War, I studied by candlelight. Electric conveniences such as refrigerators and fans were largely unknown. Yet within my lifetime, that reality changed utterly. Easy access to energy opened abundant new possibilities for my family and my nation.

Energy transforms lives, businesses and economies. And it transforms our planet — its climate, natural resources and ecosystems. There can be no development without energy. Today we have an opportunity to turn on the heat and lights for every household in the world, however poor, even as we turn down the global thermostat. The key is to provide sustainable energy for all.

To succeed, we need everyone at the table — governments, the private sector and civil society — all working together to accomplish what none can do alone. The United Nations is well-placed to convene this broad swathe of actors and forge common cause between them. That is why I have established our new initiative, Sustainable Energy for All. Our mission: to galvanize immediate action that can deliver real results for people and the planet.

This is the message I will bring to the World Future Energy Summit in Abu Dhabi starting Monday. As I see it, we face two urgent energy challenges.

The first is that one in five people on the planet lacks access to electricity. Twice as many, almost 3 billion, use wood, coal, charcoal or animal waste to cook meals and heat homes, exposing themselves and their families to harmful smoke and fumes. This energy poverty is devastating to human development.

The second challenge is climate change. Greenhouse gases emitted from burning fossil fuels contribute directly to the warming of the earth’s atmosphere, with all the attendant consequences: a rising incidence of extreme weather and natural disasters that jeopardize lives, livelihoods and our children’s future. More

Tuesday, January 10, 2012

Energy Wars 2012

Last week, the president made a rare appearance at the Pentagon to unveil a new strategic plan for U.S. military policy (and so spending) over the next decade.

Let’s leave the specifics to a future TomDispatch post and focus instead on a historical footnote: Obama was evidently the first president to offer remarks from a podium in the Pentagon press room. He made the point himself -- “I understand this is the first time a president has done this. It’s a pretty nice room. (Laughter)” -- and it was duly noted in the media. Yet no one thought to make anything of it, even though it tells us so much about our American world.After all, when was the last time the president appeared at a podium at the Environmental Protection Agency to announce a 10-year plan for a “leaner, meaner” approach to the environment, or at the Education Department to outline the next decade of blue-skies thinking (and spending) for giving our children a leg-up in a competitive world? Or how about at a State Department podium to describe future planning for a more peaceable planet more peaceably attained?

Unfortunately, you can’t remember such moments and neither can America’s reporters, because they just aren’t part of Washington life. And strangest of all, no one finds this the tiniest bit odd or worth commenting on. Over the last decade, this country has been so strikingly militarized that no one can imagine 10 years of serious government planning or investment not connected to the military or the national security state. It’s a dangerous world out there -- so we’re regularly told by officials who don’t mention that no military is built to handle the scariest things around. War and the sinews of war are now our business and the U.S. military is our go-to outfit of choice for anything from humanitarian action to diplomacy (even though that same military can’t do the one thing it’s theoretically built to do: win a modern war). And if you don’t believe me that the militarization of this country is a process far gone, check out the last pages of Secretary of State Hillary Clinton’s recent piece, “America’s Pacific Century,” in Foreign Policy magazine.

Then close your eyes and tell me that it wasn’t written by a secretary of defense, rather than a secretary of state -- right down to the details about the “littoral combat ships” we’re planning to deploy to Singapore and the “greater American military presence” in Australia. More

Monday, January 9, 2012

The Peak Oil Crisis: Closing Out The Year

The returns are in and we now know that world price of a barrel of oil averaged $111 in 2011. This was up 14 percent from last year and well above the previous high of $100 set in 2008.

The average barrel of oil that we bought last year cost $15 more than the year before. Here in America, we burn about 6.7 billion barrels of the stuff each year. Therefore, our collective oil bill for 2011 was about $100 billion higher for the same amount of energy that we burned in 2010. This $100 billion created few new jobs here in the USA. Much of it went overseas and into the coffers of people who don't like us very much.Last year's news was dominated by the Arab spring and its derivatives which spread from Wall Street, to Moscow, to villages in China as the revolution in communications technology coalesced in the hands of a new generation making dissidence against governments everywhere far easier to organize. By the way, the latest count of cell phones shows that in excess of 5 billion have been produced. Not all of these are still active, of course, but for a world of 7 billion people, many of whom are too young to talk much less carry a mobile phone, that is an impressive number. It is clear the world is changing in ways we cannot yet comprehend.

The peak oil story changed little last year. Global oil production hung in around 88 million barrels a day (b/d) despite the Libyan uprising which took nearly 1.6 million b/d out of production for several months. For much of last year global oil production was below consumption resulting in a gradual drawdown of world reserves. With OECD stockpiles of about 2.6 billion barrels, plus the new reserves being accumulated in China, a slight shortfall in production is not a problem for the time being. More